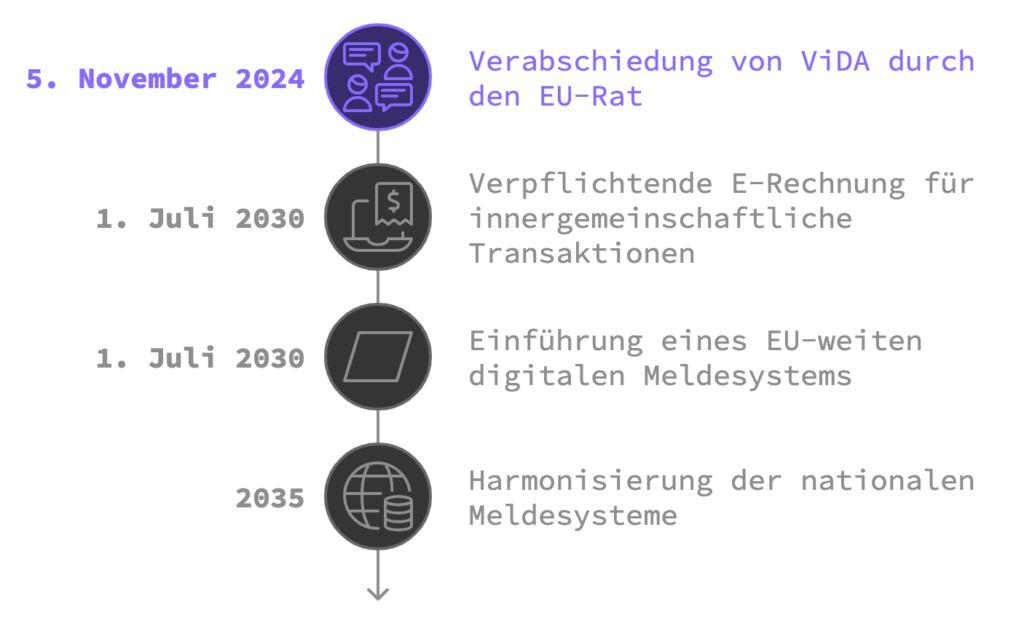

On November 5, 2024 after an almost endless back and forth the reform package “VAT in the Digital Age” ( ViDA) officially approved by the EU’s Economic and Financial Affairs Council (ECOFIN) adopted. The aim of the reform is to cross-border trade within the EU to and to reduce tax evasion to reduce tax evasion. An overview of the most important innovations and effects:

Obligation to e-invoice for intra-Community transactions

From July 1, 2030 electronic invoicing in the DIN EN 16931 format will become mandatory for intra-Community deliveries and services. This means that invoices for such transactions may only be issued in this standardized format, which must contain specific information such as a consecutive invoice number and bank details.

In addition, the deadline for issuing invoices for intra-Community supplies is shortened to a maximum of ten days after the supply has been provided or payment has been received.

Introduction of an EU-wide digital reporting system (DMS)

With the introduction of the DMS, the previous recapitulative statement (ZM) will no longer apply from July 2030. Instead, outgoing services must be reported when the invoice is issued and incoming services within five days. upon receipt be reported. The information is also transmitted in the format DIN EN 16931, which enables automated and efficient processing of tax obligations within the EU. This means that services can be automatically reconciled between companies within a maximum of 15 days. A manual Sampling – e.g. through queries from the BZSt – is no longer necessary, as incoming and outgoing sales are recorded directly and immediately on the basis of the reported information (including VAT-ID no.) can be compared.

Harmonization of national reporting systems

In addition to the EU-wide regulation ViDA EU member states to develop and harmonize their own national DMS. These systems should also enable the reporting of output and input services in a standardized format. DIN EN 16931 or interoperable alternatives. From the year 2035 , existing national reporting systems must be adapted to the new requirements in order to ensure smooth cooperation and data exchange within the EU.

Do you have any questions on this topic?

Recommendations for companies

In order to meet the new requirements, companies should start converting to the DIN EN 16931 e-invoice format at an early stage and develop internal processes for timely invoicing and reporting. The

This is all the more true as the e-invoicing obligation in Germany will be successively implemented in accordance with the same DIN EN standard from 2025.

If you have any questions or need support with the changeover, we are at your side as an experienced partner. Feel free to contact us and find out how we can make your company fit for the new EU DMS!

The author: Sven Sistig

Sven Sistig has been working in national and international tax law for 12 years, with a focus on VAT advice and support for start-ups, (online) retailers and influencers. After holding positions at Deloitte and Flick Gocke Schaumburg, he most recently headed the tax department at ABOUT YOU.